The multitude of measurements and attributes that can be included in an Environmental, Social and Governance (ESG) strategy is almost infinite, but corporate ESG programs are often focused on two specific areas.

- Reducing emissions (carbon reduction)

- Diversifying suppliers (from a people-focused, social perspective)

The environmental goal of reducing carbon or achieving carbon neutrality by a fixed point in time. This relies upon setting a goal and defining measurement criteria, then working towards that goal, normally by assessing energy usage in the production of goods and the supplier’s commitment to both reducing energy use and their dedication to using cleaner energy sources.

When it comes to diversifying suppliers, companies must consider a wider and more qualitative set of goals across the diversity and inclusion spectrum. Some of our clients have goals around supporting businesses that are smaller and more geographically local too – which doubles up as an environmental win simultaneously. There will always be metrics involved but supported by policies and processes that lean toward progression in a direction of equality and inclusion.

These two key areas appear at first to be rather different in how they need to be tackled, but we’ve recently worked with our customers in extremely similar ways to achieve amazing ESG outcomes – maximising impact for minimal investment.

The approach is rooted in a simple matrix that as a supply chain professional you’re aware of either subconsciously or explicitly and a practice you’re probably already involved in.

In this article, we discuss the model and how to use it to shortcut and hack your way to ESG excellence.

The Kraljic matrix

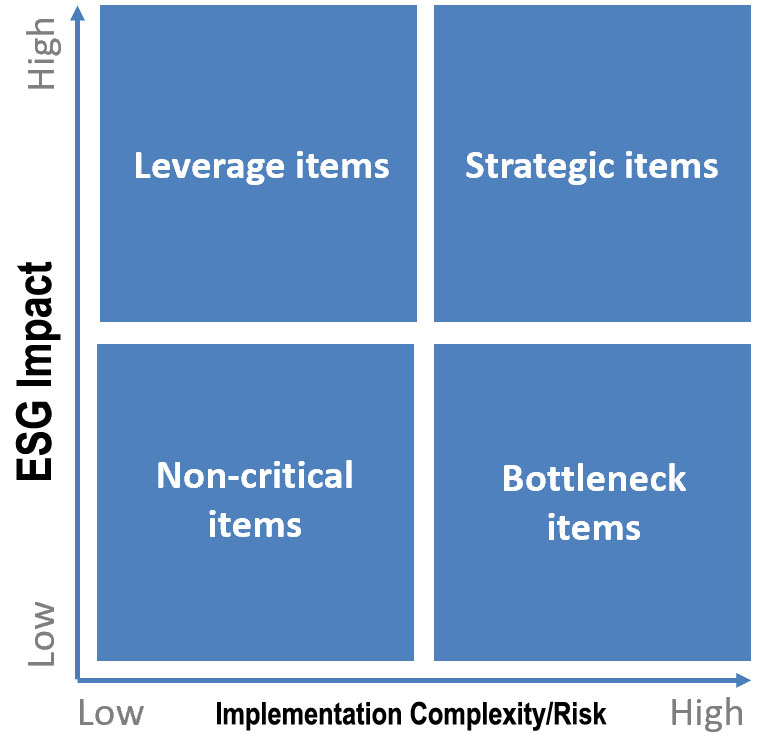

The easiest way to achieve the biggest ESG wins is by segmenting your supply chain base into four categories, adapting the Kraljic matrix slightly by changing the profit impact to carbon or diversity impact whilst maintaining the risk/complexity X axis.

The simplicity of this model is disproportionate to its power. Analysing spend categories based on the size of the spend, potential impact on ESG metrics and the ease of implementation is an extremely strong starting point in any ESG programme.

The Kraljic matrix defines four segments – and here’s how we interpret the in an ESG context:

Non-critical

Suppliers that have a low impact on the ESG impact of the company and that are found in abundance and/or in low-risk markets (e.g., office stationery). When placing your spend category into this segment of the matrix, the goal should be to maximize the efficiency of the procurement process to reduce the administrative burden rather than look for diversity and carbon reduction gains. The spend, nor the impact warrants strategic objective setting or high-touch relationship management – despite the ease of implementation.

Leverage

these are suppliers that are important for the company’s ESG goals but are sourced from low-risk markets with an abundant supply. The ESG impact of changing suppliers can be high, but the risk of changing is low. The optimal management of these purchase categories is essential to ensure the most advantageous ESG result. For this type of supplier, the supply chain team can make the most of its bargaining power and the abundance of supply by frequently negotiating with the market and prioritising suppliers that have the strongest ESG credentials.

Bottleneck

this is where you categorise suppliers with a low ESG impact and where there is a complexity to the implementation of any measures to reduce carbon or increase diversity. An example of this could be where there is risk in supply continuity or very limited supply due to the nature of the goods or services being in a particular niche.

The management of these suppliers is normally aimed at creating relationships of collaboration in the medium-long term to guarantee the supply, with less emphasis on the ESG metrics. The spending could be relatively high in these areas, but there are often smaller gains to be made on carbon reduction or diversity.

Strategic

This is your starting point for the ESG program as there are the largest gains to be made in ESG terms due to the size of spend, but unfortunately, this is matched with the complexity of implementation.

Suppliers in this quartile are important for the company both in terms of ESG impact and could be operating in difficult supply conditions from complex and/or risky markets.

Suppliers that fit into this zone should be handled differently through an ESG lens, the horizon is a medium-long term with continuous monitoring of the overall situation of the market alongside the carbon reduction credentials and diversity programmes your suppliers are implementing.

The focus for suppliers in these strategic ESG spend categories is one of creating stable relationships and maximum collaboration to align goals and work towards them to achieve mutual success.

The Matrix Reloaded

Once you’ve mapped the supply chain into these four segments based on the ESG impact and ease of implementation – that’s when the real work begins to strengthen the programme with data.

This can be a challenge in itself to collect and store in a structured way that encourages unbiased, insightful analysis. But this is exactly why SourceDogg exists, to help provide a single source of truth for supplier data and then manage relationships through collaboration. Our supplier master data module is cloud-based and self-service for the suppliers, minimising data entry and helping you redeploy your resources to identify key areas of high-impact ESG suppliers rather than on repetitive admin.

We’re convinced that a successful ESG program all starts with a clear view of your data, albeit with a fresh carbon-reduction or workforce diversity perspective. We’ve recently written about the Four-Step Process to Structure Supplier Data for this use case and we’d love to help you manage your ESG excellence the smart way. Our team can show you around the platform in a personalised demo and help you translate those ESG goals into a manageable, simple reality.